|

If you’re in the market for an insured mortgage, then you might want to get that mortgage before March 17.

Canada Mortgage and Housing Corporation (CMHC) is raising premiums for insuring mortgages on Canadian homes for the third time in three years. Canadian home-buyers are required to have mortgage insurance if they have less than a 20 per cent down-payment. The insurance provides protection for the lender in the case of a default. How will it hit your wallet? The increase is not too significant for those making the minimum down-payment required. A home-buyer with a $250,000 mortgage and a 5 per cent down-payment will only pay about $5 per month more in insurance premiums. I can calculate exactly how much the increase will mean to you if you get your mortgage approval on or after March 17. The increases are actually more substantial for larger downpayments of 15 per cent or more. Those with 20 per cent or more down-payment aren’t required to have mortgage insurance, although it’s used by lenders that securitize their mortgages. As a result, any increased cost will likely be passed on to customers through higher rates. Premiums are also increasing for “non-traditional” insured mortgages i.e. home buyers with borrowed down-payments, a type of mortgage down-payment that could grow in popularity as home-buyers strive to gain entry in the housing market. The premium change will come into effect on March 17. Home-buyers will be able to access the current lower rates if they have bought a home and are approved before the March 17 deadline, even if they have a later closing date. If you are looking to buy, get in touch today! 90-day RRSP down payment boost for first-time buyers ends March 1! If you’re buying your first home, the Federal Home Buyers’ Program (HBP) and a tax refund can boost the funds you have available. Make as big an RRSP contribution as you can before the March 1 contribution deadline for the 2016 tax year – up to your contribution limit or the maximum $25,000 per person. Use your down-payment savings if you can because you want as big a 2016 refund as possible. After 90 days you can redeem your contribution under the HBP program, giving you your original down-payment funds back PLUS a nice fat tax refund. You’ll need to pay the withdrawn funds back on a repayment plan, but this strategy can make a substantial difference in the affordability of home ownership.

0 Comments

Feeling the post-holiday financial squeeze? You’re not alone. January and February credit card bills are arriving to remind us how much we spent on the festive season. That's why this is the perfect time to make sure you have the financial control you need to achieve your goals. Here are some strategies that can help:

Have a great day!! Despite the latest frightening news about soaring Canadian house prices, there are good reasons for millennials to pursue home ownership.

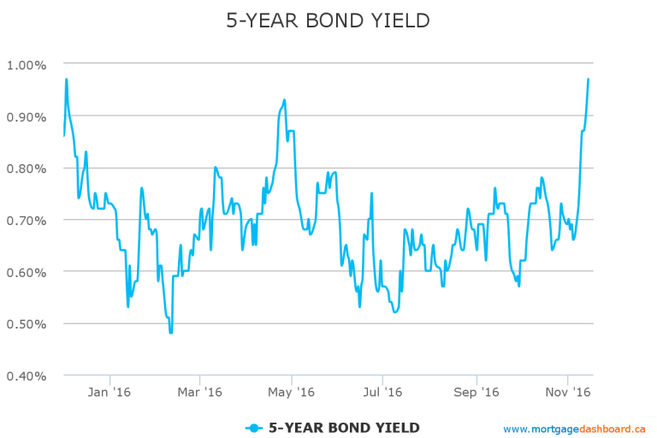

For many, the hardest question is whether it remains possible at all. But for some under-35s, the issue is whether the financial risks of home ownership outweigh the benefits. As Jacqueline Hansen reported yesterday based on data from the Bank of Montreal, more than half of Canadian millennials already own their own piece of real estate. Not only that, but of the 49 per cent who don't own already, a large majority of them — a whopping 64 per cent — are saving with the intent of buying. Affordability fallsSo despite a report from RBC just before Christmas that Canadian home ownership is less affordable than it has been in eight years, under-35s are still in the market. Are they crazy? To find out I asked one. As well as being a CBC business reporter, Hansen is a millennial who recently bought a condo in Toronto's pricey market. "Buying was the only way I could find a place that I was proud of, that I could feel good coming home to," Hansen says. CBC reporter Jacqueline Hansen, as well as reporting on millennials, is one herself. She recently decided to buy a condo in Toronto's pricey market. (CBC) Like many other young people, the CBC reporter didn't jump into it. Just like the people she interviewed for her own report, when she moved to Toronto she lived in what she describes as small and unpleasant rental bachelor apartments while taking a series of short-term contract jobs. Getting a mortgage when you're engaged in contract work is much more difficult. The finance minister says people must learn to live with "job churn," but it appears many mortgage lenders did not get the memo. It was only after settling into a full-time job that Hansen took the plunge. Putting down rootsTemporary or part-time work makes it hard to know whether you'll stay or move someplace with better opportunities. "Now that I own a place, I feel that I have roots here," Hansen says. A dissatisfaction with rented accommodation is more than just a millennial affectation, according to real estate specialist Tsur Somerville, it's part of the Canadian market reality. Relative to other parts of the world — an exception being the city of Montreal — a high level of home ownership is "the cultural norm" in Canada, says Somerville, professor at the Sauder School of Business at the University of British Columbia. "Because we are a relatively high home-ownership society, if you want to remain a renter, your choices end up being somewhat limited," says Somerville. Condo developments such as this one in Hamilton are available to buy in many different price ranges, but in the Canadian market rental properties don't provide as much choice. (Vernon Shaw) Our cultural preference for ownership means most of the nicest homes and the nicest neighbourhoods are places where people own, not rent. Unlike places such as South Korea or parts of Europe where it's assumed people will stay in a single rented flat for decades, in Canada it's much harder to find a place where renters can be confident they will be able to stay and settle into a neighbourhood. Hansen is confident that if she could rent a place as nice as her current home, it would cost more than paying for her condo. She bought about a year ago and every time prices rise the deal gets better. Market uncertaintySomerville says the real estate boom we've seen in Toronto adds an extra challenge for young buyers. As prices shoot higher, buyers must decide whether to move quickly while they can afford it. Alternatively, they must worry about what will happen if interest rates suddenly rise or prices tumble. Average home prices are roughly twice the price relative to incomes as they were in 1984. But mortgage rates then were double digit. The secret then as it is now is not to get in over your head. Scraping together a down payment wasn't easy a generation ago either. And while Toronto and Vancouver single-family homes may be outside the reach of first-time buyers, the price of condos makes entering the property market, with the idea of moving up in future, as attainable as it has ever been. Coal Harbour condo towers in Vancouver where single family homes are well out of the price range of most first time buyers. (David Horemans/CBC) Just as it was for their parents, home ownership for millennials is a mark of success. It's a sign that you've got a steady income, that you are ready to settle in for a while and put down roots, that you've put student debts and parental influence behind you. But does it pay?From a strictly financial point of view, Somerville's research shows that buying a home is no guarantee you will be better off. "In the long run, over most markets, you can do as well renting as you can owning," he says. "If you are a disciplined saver, you don't come out any better." That caveat about "disciplined" makes a big difference. For many people, getting a mortgage and paying it down serves as a big forced-savings plan. "Like for people like myself," says Somerville. "If I was renting I would never have saved as much as I have through home equity, because I'm not that disciplined." Yes new mortgage rules have made it harder to qualify for a mortgage, whether you are a first-time buyer or looking to renew or refinance your mortgage with a new lender. That’s why you should get yourself mortgage ready well in advance. Here are 5 tips to help you do just that: 1. Get your credit report. Getting a copy of your credit report will let you know how you will be viewed by lenders. You can order yours for free through the mail or for a small fee online at www.equifax.ca. If you spot a problem, contact Equifax to resolve the issue. 2. Polish your credit. You can boost your score by several points fairly quickly with continual good credit habits. Most importantly, pay your bills on time, every time. Don’t let your credit accounts exceed 50% of the credit available. Before you cancel any credit cards, get advice. And don’t apply for a store card just to save on your purchase that day. Make a habit of checking your credit score each year, and watch how those good credit habits push your credit score skywards! 3. Cash is king. Plan to go into homeownership with the maximum downpayment possible. If you are in the "saving up" stage of preparing for homeownership, now is the time to meet. There are several downpayment savings strategies available that we can put to work for you. 4. Get a boost from family. Parents and grandparents have enjoyed the personal and financial benefits of home ownership themselves, and see how hard it is today to make that important first step into the market. Check to see if they are willing to help by gifting or loaning some or all of the downpayment, or by helping you with other debts. 5. Start a dialogue early. Get in touch early to talk about your purchase, refinance or renewal plans. I can help you be fully prepared to get you where you want to go, and to make sure you can take advantage of any opportunities that come your way. Also remember, history has proven that it is almost impossible to perfectly time the market. Home ownership has proven to be a very solid investment over the long term, so focus on buying a home when you are financially ready and when it fits your lifestyle;  Donald Trump has “blown up” the bond market. That’s CNBC’s depiction after the president elect’s victory wiped out $1+ trillion of its value in the last week. Trumponomics, Trumpflation, the Trump Thump, Trumpulus, or whatever you want to call it, has incited fear in bondland. Traders envision 4%+ GDP growth, inflation, massive deficits, a potential U.S. credit rating downgrade and unravelling of the greatest bond bull market of all time. All of this is conspiring to reshape investors’ mindsets…radically. It’s raising the implied odds that 2016’s bottom in rates won’t be broken for several quarters, at a minimum. And if the bond market is somehow mispricing Canada’s economics prospects—and yields do fall 55+ bps to new lows—imagine what hideous fate that would portend for Canada. It’s a fate that, given a soon-to-be-robust U.S. economy (the destination for 73% of our exports), now seems Less probable But make no mistake, we’re staring at much uncertainty through 2018, not the least of which is:

But here’s something we can tell clients with confidence. The rate paradigm as we knew it on November 7th was transformed on November 8th. In 2017, the economy that we sell three-quarters of our goods and services to will be firing on two more cylinders, and net net, that could help Canadian business, boost Canadian inflation and be rate bullish. And if we’re wrong, borrowers will have far bigger problems to contemplate than not picking the bottom in interest rates. Should you stress about the stress test?

What you should know about new mortgage rules. On October 3rd, Finance Minister Bill Morneau announced that new mortgage rules will include more stringent “stress testing” for borrowers. The new rules are designed to lower debt levels, enforce some belt-tightening, and protect the housing market over the long term. Here’s how these new rules will affect Canadians. THE HIGH-RATIO RULE There has been a long-time rule that you must have “high-ratio mortgage insurance” if you have less than 20% down payment. This insurance is there to protect the lender, and the premium is almost always added to your mortgage amount. What’s changed? If you require an insured mortgage, you must qualify for your mortgage using the Bank of Canada qualifying rate (currently 4.64%) regardless of what your actual mortgage rate will be. That means that – although I can find you a much better mortgage rate – you’d still need to show you can handle the mortgage using the qualifying rate. This financial “stress test” was already applicable for fixed and variable mortgages with terms of 1 to 4 years. Now, it also applies to fixed-rate mortgages of 5 years or longer. Why the new rule? The government wants to be sure that borrowers can withstand any increases in mortgage rates when their mortgages come up for renewal. Will my payments be higher? No. Your payments will still be based on your much lower actual mortgage contract rate. Keep in mind that mortgage rates are expected to stay at record lows into 2020. So this new rule isn’t costing you more. The potential change will be in how much mortgage you will qualify for: up to 20% less. You may need to plan on purchasing a less expensive home, or save up a larger down payment, or ensure you eliminate all or most of your other debts. Are any loans grandfathered? The new mortgage stress test does not apply when:

THE CONVENTIONAL MORTGAGE RULE Maybe you have more than 20% down or equity in your home and you are planning to purchase, renew or refinance. Since you have strong equity, you aren’t considered a “high-ratio” borrower. What's changed? Effective November 30th, any mortgage loans that lenders insure using portfolio insurance must now meet eligibility criteria applicable to “high ratio” mortgages, including the new qualifying stress test. This means that rental properties, properties over $1 million, and mortgages with an amortization greater than 25 years will no longer be eligible for portfolio insurance. Does this mean I will have trouble getting a mortgage? Certainly not. The change will only affect certain lenders that insure or securitize these types of mortgages. I have access to a wide range of lenders, which means I can help you find the best mortgage for your situation. But if you are thinking of refinancing, get in touch now just to be sure you lock in a low rate. THE CAPITAL GAINS REPORTING RULE Canadians love the capital gains exemption they get on their primary residence: if your home grows in value, you aren’t taxed on that growth when you sell. What's changed? Starting this tax year, the sale of a primary residence must be reported at tax time to the Canada Revenue Agency, even though all capital gains are still tax exempt. Why? This new rule was designed to prevent foreign property purchasers from claiming a primary residence tax exemption to which they are not entitled. Although there are definite regional variations, the Canadian housing market is strong. A good part of the reason for that strength is that we have had stringent mortgage requirements. Mortgage defaults in Canada continue to be very low: in spite of the ups and downs of the economy. The new rules are aimed at ensuring home ownership continues to be a solid, long-term investment. Give me a call: I’ll help ensure you make the most of it!

|

Sylvie Ann Messer

|

RSS Feed

RSS Feed