What is a Chip? CHIP is a reverse mortgage, which is described as a loan secured against the value of the home. It

allows the homeowner to qualify for up to 55% of their home value and convert it into cash to

pay off debt, use as an income stream and retirement planning or renovate their home without having to move or sell.

allows the homeowner to qualify for up to 55% of their home value and convert it into cash to

pay off debt, use as an income stream and retirement planning or renovate their home without having to move or sell.

|

|

|

|

|

Benefits of CHIP?

Relieve financial stress Your clients can qualify for up to 55% of the equity in the home to pay off debt or unforeseen expenses. No payments No payments are required (principal or interest) for as long as the homeowner lives in the home. Maintain Ownership With CHIP, the homeowner maintains title ownership of the home. Tax-Free Money The money accessed with CHIP is tax-free. Who should I offer CHIP to? Clients that are homeowners over the age of 55 who are in need of money to pay debt or expenses. As the life expectancy age rises in Canada, it is important that your clients have a stress-free and financially stable retirement. Success stories After first learning about CHIP from her mortgage broker, Karen used her money to pay off debt that had built up after her husband’s stroke. Creditors are no longer calling, and she is now free to spend quality time with her husband. Bill and Linda learnt about CHIP from their banker, and after learning about all the benefits, used the money for much needed home renovations and repairs which they weren’t able to previously pay for. Miriam was able to take a trip she always promised herself with extended family and friends without having to take money from her precious retirement savings. |

Repaying the loan

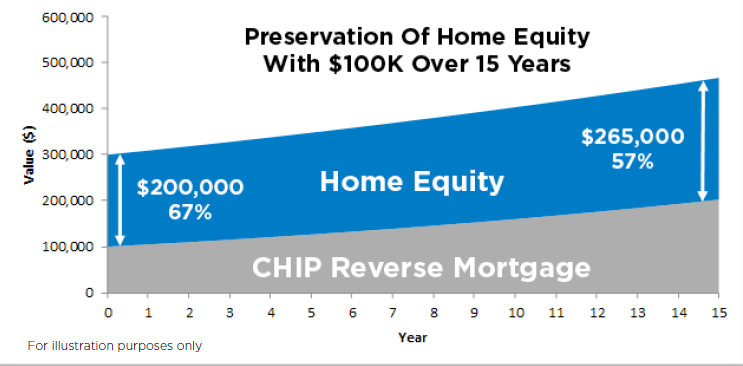

The loan is only required to be repaid when the homeowner no longer lives in the home. With close to 30 years of offering reverse mortgages, 99% of clients have equity remaining in the home when the loan is repaid. Below is an example illustrating the preservation of equity over a 15 year period. Calculations based on a CHIP rate of 4.75% and home

appreciation of 3% annually. This chart is an illustration for a client who owns a $300,000 home and took a lump sum of $100,000 with their CHIP Reverse Mortgage. The chart shows how the client maintains a large portion of equity in the home. This is due to HomEquity Bank’s conservative lending practices combined with typical home appreciation, as well as a low interest rate environment. INVIS

Fredericton, NB Sylvie Ann Messer Mortgage Professional - Invis License # 160000397 Office: 506-206-3672 Cell: 506-471-3775 | Fax: 506-206-4655 |